Effortless Financial Management: Mastering QuickBooks Online's Recurring Transactions

Since we're still in the early weeks of 2024, now is the perfect time to improve your business operations with QuickBooks for a more efficient and prosperous year ahead. QuickBooks Online continues to provide a wide array of bookkeeping and accounting features to simplify financial management tasks, particularly for small business owners. One notable feature is the capability to set up recurring transactions, a powerful tool that can save time and automate certain expenses.

Whether you prefer QuickBooks Online or QuickBooks Desktop, integrating recurring transactions into your financial processes can significantly streamline day-to-day operations. Here, we look at the strategies you can use to optimize recurring transactions specifically within the QuickBooks Online system.

Mastering Recurring Transactions In QuickBooks Online

For businesses with regular monthly expenses (excluding bills), QuickBooks Online's recurring transactions feature can be an incredibly useful tool. By establishing recurring templates for specific costs, business owners can automate processes, ensuring timely payments. This feature is particularly beneficial for businesses with subscription-based revenue models, allowing effortless creation of recurring invoices, thereby saving time and preventing delays in subscriber payments.

Creating Recurring Templates

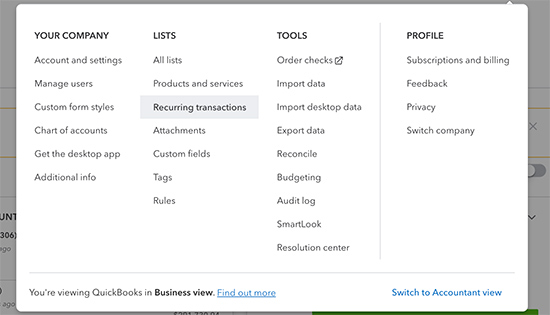

Access Your Settings: Log in to your QuickBooks Online account and go to the Settings ⚙ menu.

Select Recurring Transactions: In the Settings menu, find and select "Recurring Transactions."

Create a New Template: Click on "New" to create a new recurring template.

Choose Transaction Type: Select the transaction type you want to make recurring (excluding bill payments and time activities). Click "OK."

Name Your Template: Give your template a descriptive name for easy identification.

Specify the Type: Choose the template type – Scheduled, Unscheduled, or Reminder – depending on the transaction nature and recurrence frequency.

Complete the Template: Fill in all necessary fields, including payee or customer details, items or services involved, and any relevant information.

Save the Template: Once the template is completed, save it. Your recurring transaction is now set up, automating your financial processes.

Duplicating Existing Templates

QuickBooks Online also facilitates an expedited template creation process by allowing users to duplicate existing templates. Here's how:

Access Settings: Again, navigate to the Settings ⚙ menu.

Select Recurring Transactions: Click on "Recurring Transactions."

Choose a Template: Select the one you want to duplicate from your list of recurring templates.

Duplicate the Template: In the Action column dropdown menu, choose "Duplicate." The duplicate will inherit all settings from the original template, except for the title.

Edit as Needed: Customize the duplicated template by editing fields, making adjustments, or adding new details.

Save the Duplicate: Save your duplicated template, and it's ready for use.

Recurring transactions in QuickBooks Online simplify financial management tasks for business owners in all industries. By automating routine transactions and reducing manual data entry, you'll save valuable time and minimize the risk of errors in your financial records. When it comes to managing business accounting, QuickBooks' recurring transactions feature is a valuable tool contributing to overall efficiency.

More About Us

Get to Know Prestige Accounting Services Group

Offices in Flemington, NJ, and Califon, NJ

Our Mission: At Prestige Accounting Services Group, we are on a mission to redefine the tax experience for individuals and small businesses. With a focus on personalized service, strategic planning, and expert guidance, we aim to empower our clients to succeed financially with confidence and ease.

Expertise in Action: With a wealth of experience and a team of dedicated professionals, we specialize in individual and small business tax preparation. While we excel in all areas of taxation, our passion lies in serving the unique needs of small business owners in New Jersey. We understand that small business taxation requires specialized knowledge and attention to detail, which is why we go above and beyond to ensure our clients receive the guidance and support they deserve.

Tailored Solutions for Every Client: Whether you're a high-net-worth individual seeking comprehensive tax planning or a small business owner in need of accounting and bookkeeping assistance, we have the expertise to meet your needs. Our team takes the time to understand your specific situation and develop customized solutions that align with your goals and objectives.

Why Choose Us?: What sets us apart from other New Jersey tax firms is our commitment to excellence and innovation in the field of taxation. We don't just prepare tax returns; we provide strategic insights, proactive planning, and actionable advice to help our clients achieve their financial goals. With a team of two CPAs, an EA, and an ERO, we have the expertise and resources to deliver exceptional service and results.

Your Success is Our Priority: At Prestige Accounting Services Group, we measure our success by the success of our clients. We are dedicated to building long-lasting relationships, providing unparalleled service, and helping our clients thrive in today's ever-changing tax landscape.

We can't wait for you to experience the Prestige Accounting Services Group difference.

Tax & Small Business Updates

Get the latest in tax and small business updates and issues that affect your finances and growth prospects.