Keep Up With Payables: Paying Bills in QuickBooks

This month, we’ll discuss paying your bills in QuickBooks. Click Pay Bills on the home page or open the Vendors menu and select Pay Bills. The screen that opens displays bills that you’ve entered that need to be paid. You can choose to list those due on or before a date you specify or all bills.

QuickBooks provides templates that you can use when you’re entering bills. You have to complete these forms before you can apply payment.

By default, all vendors are represented in the table. If you want to only see bills from one specific vendor, click the down arrow in the Filter By field and select he correct one. You can also sort the list by any of a number of criteria, including Due Date, Vendor, and Amount To Pay by clicking the down arrow in the Sort By field.

Once the table is displaying your bills the way you want, it’s time to select the ones you want to pay. You can either click in the box in front of each to make a checkmark or click on Select All Bills below the table. When you select one, the Amount To Pay field will change to reflect the Amount Due. If you can’t afford the whole payment, replace the 0.00 in the Amount To Pay field with your actual planned payment.

You can select individual bills to pay in QuickBooks or click on Select All Bills below the table.

QuickBooks provides additional information in the table of bills to be paid beyond Date Due, Vendor, and Amount To Pay. You’ll see a column for a reference number, but there are other columns that can display vendor-issued discounts and credits that could be applied to individual bills. Vendors sometimes offer discounts for early payment, for example, and credits can be issued to settle things like returns or overpayment.

Warning: If you’ve never worked with discounts and credits, we can help you learn about them, create them, and apply them. It’s complicated.

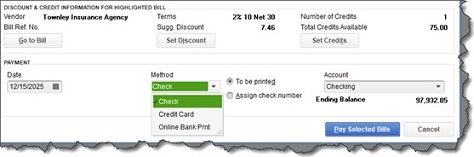

When you’re satisfied with the information in the table, look below it. Highlight a bill by clicking on it to see what your options are there. You can click

Go to Bill to see the original form. If there are discounts or credits available, they will appear there as Sugg[ested] Discount and Total Credits Available. You’ll also notice that any discounts or credits will have been applied in the table above. To change these, click Set Discount or Set Credit.

Make sure the payment Date is correct and select the payment Method. If you select Check, you’ll have to choose between To be printed or Assign check number (for handwritten checks, you’ll be able to specify the number or let QuickBooks assign it in the next window). Select the correct payment Account and click Pay Selected Bills. A Payment Summary appears in the window that opens. You can either click Pay More Bills or Done. If you’re paying bills using more than one payment method, you’d go back to the previous screen and repeat the process.

The lower half of the Pay Bills window

Helpful Automation

As you saw in this example, QuickBooks applied discounts and credits automatically when you selected a bill. To set this up, open the Edit menu and select Preferences, then Bills. Click on the Company Preferences tab, which opens the screen for company-wide preferences that are established by the Administrator.

Click in the boxes in front of Automatically use credits and Automatically use discounts. Then click on the down arrow in the field next to Default Discount Account to open the list. There should be an Income account labeled Discounts. Select this one, then click OK.

QuickBooks provides three reports that help prevent bills from slipping through the cracks. Open the Reports menu and go to Vendors & Payables, then A/P Aging Summary and Detail, and Unpaid Bills Detail. If you’re running into problems with your accounts payable workflow and want some guidance on that or any other element of QuickBooks, we’d be happy to work with you.

More About Us

Get to Know Prestige Accounting Services Group

Offices in Flemington, NJ, and Califon, NJ

Our Mission: At Prestige Accounting Services Group, we are on a mission to redefine the tax experience for individuals and small businesses. With a focus on personalized service, strategic planning, and expert guidance, we aim to empower our clients to succeed financially with confidence and ease.

Expertise in Action: With a wealth of experience and a team of dedicated professionals, we specialize in individual and small business tax preparation. While we excel in all areas of taxation, our passion lies in serving the unique needs of small business owners in New Jersey. We understand that small business taxation requires specialized knowledge and attention to detail, which is why we go above and beyond to ensure our clients receive the guidance and support they deserve.

Tailored Solutions for Every Client: Whether you're a high-net-worth individual seeking comprehensive tax planning or a small business owner in need of accounting and bookkeeping assistance, we have the expertise to meet your needs. Our team takes the time to understand your specific situation and develop customized solutions that align with your goals and objectives.

Why Choose Us?: What sets us apart from other New Jersey tax firms is our commitment to excellence and innovation in the field of taxation. We don't just prepare tax returns; we provide strategic insights, proactive planning, and actionable advice to help our clients achieve their financial goals. With a team of two CPAs, an EA, and an ERO, we have the expertise and resources to deliver exceptional service and results.

Your Success is Our Priority: At Prestige Accounting Services Group, we measure our success by the success of our clients. We are dedicated to building long-lasting relationships, providing unparalleled service, and helping our clients thrive in today's ever-changing tax landscape.

We can't wait for you to experience the Prestige Accounting Services Group difference.

Tax & Small Business Updates

Get the latest in tax and small business updates and issues that affect your finances and growth prospects.