Simplify Your Business With Recurring Transactions In QuickBooks Online

QuickBooks Online offers a world-class set of bookkeeping and accounting features designed to simplify financial management tasks for all business owners. Among these features is the ability to set up recurring transactions. This powerful, time-saving tool is a great way to automate certain expenses and payments.

Whether you're using QuickBooks Online or QuickBooks Desktop, recurring transactions can help you streamline your day-to-day financial processes. In this guide, we'll explore how to make the most of recurring transactions in the QuickBooks Online system.

QuickBooks Online: Mastering Recurring Transactions

Recurring transactions in QuickBooks Online are invaluable for businesses that have regular monthly expenses – note that bills are not eligible for the recurring transactions feature, however. By setting up recurring templates for certain costs, business owners can automate the process, ensuring they never miss a payment. Additionally, QuickBooks Online's recurring transactions are ideal for businesses with subscription-based revenue models. This makes it simple for proprietors to effortlessly create recurring invoices, saving time and preventing late payments from subscribers.

Creating Recurring Templates

Access Your Settings: Log in to your QuickBooks Online account and navigate to the Settings ⚙ menu.

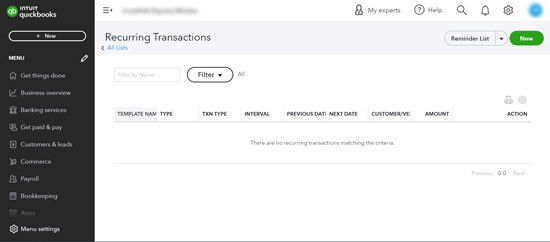

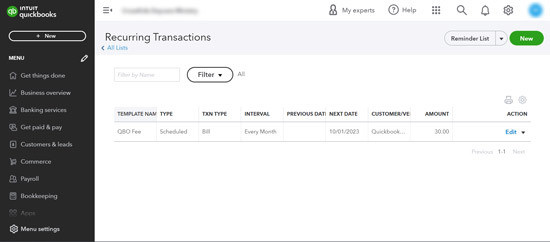

Select Recurring Transactions: In the Settings menu, locate and select "Recurring Transactions."

Create a New Template: To create a new recurring template, click on "New."

Choose Transaction Type: Select the type of transaction you want to make recurring. QuickBooks Online allows you to create templates for various transaction types, except for bill payments and time activities. Once selected, click "OK."

Name Your Template: Give your template a descriptive name to easily identify it.

Specify the Type: Choose the template type: Scheduled, Unscheduled, or Reminder. Your choice depends on the nature of the transaction and when you want it to recur.

Complete the Template: Fill in all the necessary fields for the transaction. This includes details like the payee or customer, items or services involved, and any other relevant information.

Save the Template: Once you've completed the template, save it. Your recurring transaction is now set up and ready to automate your financial processes.

Duplicating Existing Templates

QuickBooks Online also allows users to expedite the template creation process by duplicating existing templates. Here's how:

Access Settings: Again, navigate to the Settings ⚙ menu.

Select Recurring Transactions: Click on "Recurring Transactions."

Choose a Template: From your list of recurring templates, select the one you want to duplicate.

Duplicate the Template: In the Action column dropdown menu, choose "Duplicate." The duplicate copy will inherit all settings from the original template, except for the title.

Edit as Needed: Customize the duplicated template by editing fields, making adjustments, or adding new details.

Save the Duplicate: Save your duplicated template, and it's ready to use.

Harnessing the power of recurring transactions in QuickBooks Online can significantly simplify your financial management tasks. By automating routine transactions and reducing manual data entry, you'll save valuable time and reduce the risk of errors in your financial records. Whether you're managing your personal finances or handling accounting for your business, QuickBooks' recurring transactions feature is a valuable tool that can streamline your financial processes and contribute to your overall efficiency.

More About Us

Get to Know Prestige Accounting Services Group

Offices in Flemington, NJ, and Califon, NJ

Our Mission: At Prestige Accounting Services Group, we are on a mission to redefine the tax experience for individuals and small businesses. With a focus on personalized service, strategic planning, and expert guidance, we aim to empower our clients to succeed financially with confidence and ease.

Expertise in Action: With a wealth of experience and a team of dedicated professionals, we specialize in individual and small business tax preparation. While we excel in all areas of taxation, our passion lies in serving the unique needs of small business owners in New Jersey. We understand that small business taxation requires specialized knowledge and attention to detail, which is why we go above and beyond to ensure our clients receive the guidance and support they deserve.

Tailored Solutions for Every Client: Whether you're a high-net-worth individual seeking comprehensive tax planning or a small business owner in need of accounting and bookkeeping assistance, we have the expertise to meet your needs. Our team takes the time to understand your specific situation and develop customized solutions that align with your goals and objectives.

Why Choose Us?: What sets us apart from other New Jersey tax firms is our commitment to excellence and innovation in the field of taxation. We don't just prepare tax returns; we provide strategic insights, proactive planning, and actionable advice to help our clients achieve their financial goals. With a team of two CPAs, an EA, and an ERO, we have the expertise and resources to deliver exceptional service and results.

Your Success is Our Priority: At Prestige Accounting Services Group, we measure our success by the success of our clients. We are dedicated to building long-lasting relationships, providing unparalleled service, and helping our clients thrive in today's ever-changing tax landscape.

We can't wait for you to experience the Prestige Accounting Services Group difference.

Tax & Small Business Updates

Get the latest in tax and small business updates and issues that affect your finances and growth prospects.