Streamline Your Business Finances: QuickBooks Online Fund Recording Tips

As the business world becomes increasingly competitive – and increasingly digital – it is essential to maintain meticulous financial tracking and accurate recording of all incoming funds. QuickBooks Online (QBO) is an excellent resource for small business owners who are looking to do their recordkeeping in the cloud. Whether you're receiving payments for invoices, documenting instant sales, or conducting business on the go, the platform equips you with the tools you need to ensure that all of your income is correctly recorded.

Delayed Payments

If your business involves sending invoices for products or services, QBO offers multiple ways to record payments when they come in. You can opt to open the invoice directly and click on the "Receive payment" option in the upper right corner. However, accessing the "All Sales" screen provides an opportunity to review the status of other pending transactions. To navigate to this screen, click on "Sales" in the toolbar, then select "All Sales."

For those with extensive lists of sales transactions, using the Filter tool can streamline the process. Click on the down arrow next to "Filter" in the upper left to explore your search options (e.g., Status, Customer).

Once you've located the correct invoice, navigate to the bottom of that row. In the "Action" column, you'll find the "Receive payment" option. Feel free to explore other available choices by clicking on the down arrow. When the "Receive Payment" window appears, specify the applicable payment method, leave the "Deposit to" field set to "Undeposited Funds," and double-check that all information is accurate. You can print the receipt or add attachments using the provided links, then save it.

Pro Tip: Offering customers the option to make online payments tends to expedite the invoice settlement process.

Instant Payments

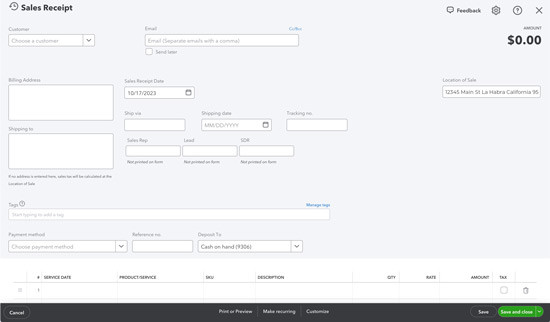

In situations where your business receives payments at the time of product or service delivery, issuing a sales receipt – rather than an invoice – is the way to go. this is also essential for your records. Simply click on the "+New" button in the upper left and select "Sales receipt" under Customers to open a blank form. You'll fill it out in a manner similar to creating an invoice. Start by selecting the customer and proceed to input or select any necessary data for the remaining fields.

If you find yourself not needing all the fields on your sales forms, don't hesitate to remove some or add custom ones. The beauty of QBO is that you can make it work for your company.

Going Mobile

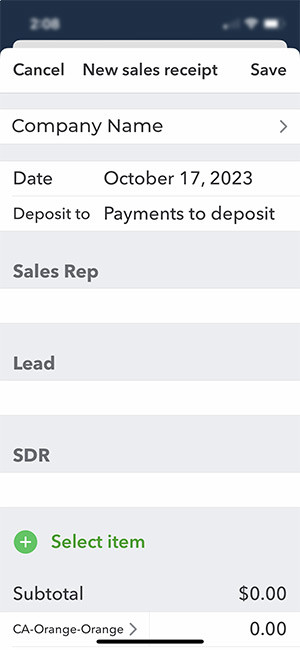

For those who conduct business on the go, the QuickBooks mobile app makes it simple for users to create sales receipts for your customers. By clicking on the plus (+) sign at the bottom of the screen and selecting "Sales Receipt," you can access a form similar to what you'd use on your desktop computer. The layout may differ, but the form's functionality remains intact.

Having a QuickBooks Payments account is especially helpful when you're making mobile sales. You can even accept credit and debit card payments by ordering a card reader directly from Intuit.

Accurate payment recording is always essential. Nowadays, with the IRS cracking down and business regulations changing all the time, it's more critical than ever to ensure that every dollar is accounted for. QuickBooks online allows you to become a more confident business owner.

More About Us

Get to Know Prestige Accounting Services Group

Offices in Flemington, NJ, and Califon, NJ

Our Mission: At Prestige Accounting Services Group, we are on a mission to redefine the tax experience for individuals and small businesses. With a focus on personalized service, strategic planning, and expert guidance, we aim to empower our clients to succeed financially with confidence and ease.

Expertise in Action: With a wealth of experience and a team of dedicated professionals, we specialize in individual and small business tax preparation. While we excel in all areas of taxation, our passion lies in serving the unique needs of small business owners in New Jersey. We understand that small business taxation requires specialized knowledge and attention to detail, which is why we go above and beyond to ensure our clients receive the guidance and support they deserve.

Tailored Solutions for Every Client: Whether you're a high-net-worth individual seeking comprehensive tax planning or a small business owner in need of accounting and bookkeeping assistance, we have the expertise to meet your needs. Our team takes the time to understand your specific situation and develop customized solutions that align with your goals and objectives.

Why Choose Us?: What sets us apart from other New Jersey tax firms is our commitment to excellence and innovation in the field of taxation. We don't just prepare tax returns; we provide strategic insights, proactive planning, and actionable advice to help our clients achieve their financial goals. With a team of two CPAs, an EA, and an ERO, we have the expertise and resources to deliver exceptional service and results.

Your Success is Our Priority: At Prestige Accounting Services Group, we measure our success by the success of our clients. We are dedicated to building long-lasting relationships, providing unparalleled service, and helping our clients thrive in today's ever-changing tax landscape.

We can't wait for you to experience the Prestige Accounting Services Group difference.

Tax & Small Business Updates

Get the latest in tax and small business updates and issues that affect your finances and growth prospects.